BUSINESS SENTIMENT

CONFIDENCE DIPS AMID UNCERTAINTY

Business sentiment trends down in the wake of lingering concerns among corporates

The trade deficit narrowed in September on the back of exports recording earnings in excess of a billion dollars for the fourth consecutive month this year. According to the Central Bank of Sri Lanka (CBSL), this alongside import expenditure remaining largely the same as in September 2020 has resulted in the deficit contracting to US$ 495 million during the month.

However, the cumulative deficit in the first nine months of the year widened to six billion dollars from US$ 4.3 billion in the corresponding period of 2020.

As for the rupee, CBSL notes that efforts to clear the backlog of essential import shipments and providing guidance on the exchange rate saw the Sri Lankan Rupee appreciate by five percent against the US Dollar during the month.

As for the rupee, CBSL notes that efforts to clear the backlog of essential import shipments and providing guidance on the exchange rate saw the Sri Lankan Rupee appreciate by five percent against the US Dollar during the month.

Gross official reserves stood at US$ 2.7 billion at end September although this does not include the three year bilateral currency swap facility between the People’s Bank of China and CBSL amounting to approximately US$ 1.5 billion.

And total foreign assets consisting of gross official reserves and the banking sector’s foreign assets amounted to 6.1 billion dollars.

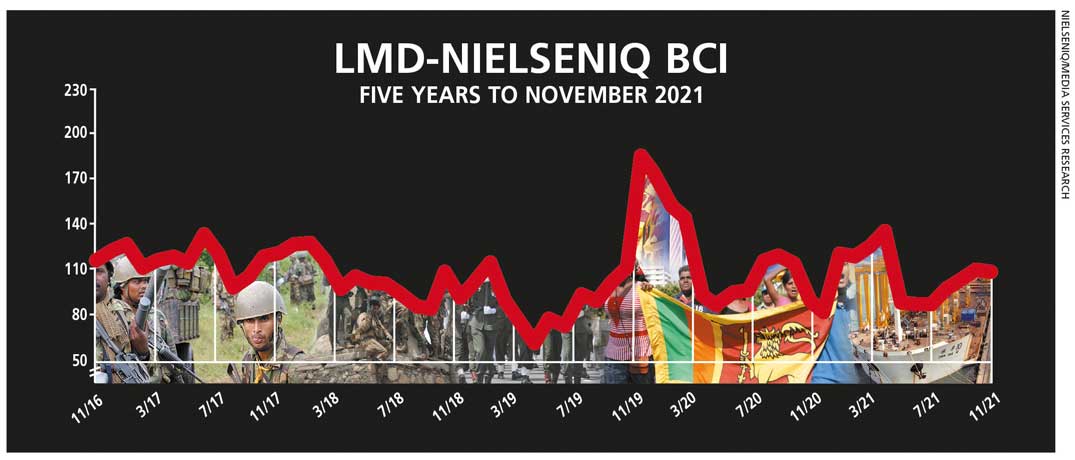

Against this backdrop, the results of the latest LMD-Nielsen Business Confidence Index (BCI) survey – which was conducted before Budget 2022 was presented in parliament – point to a deterioration in sentiment among Sri Lanka’s business community.

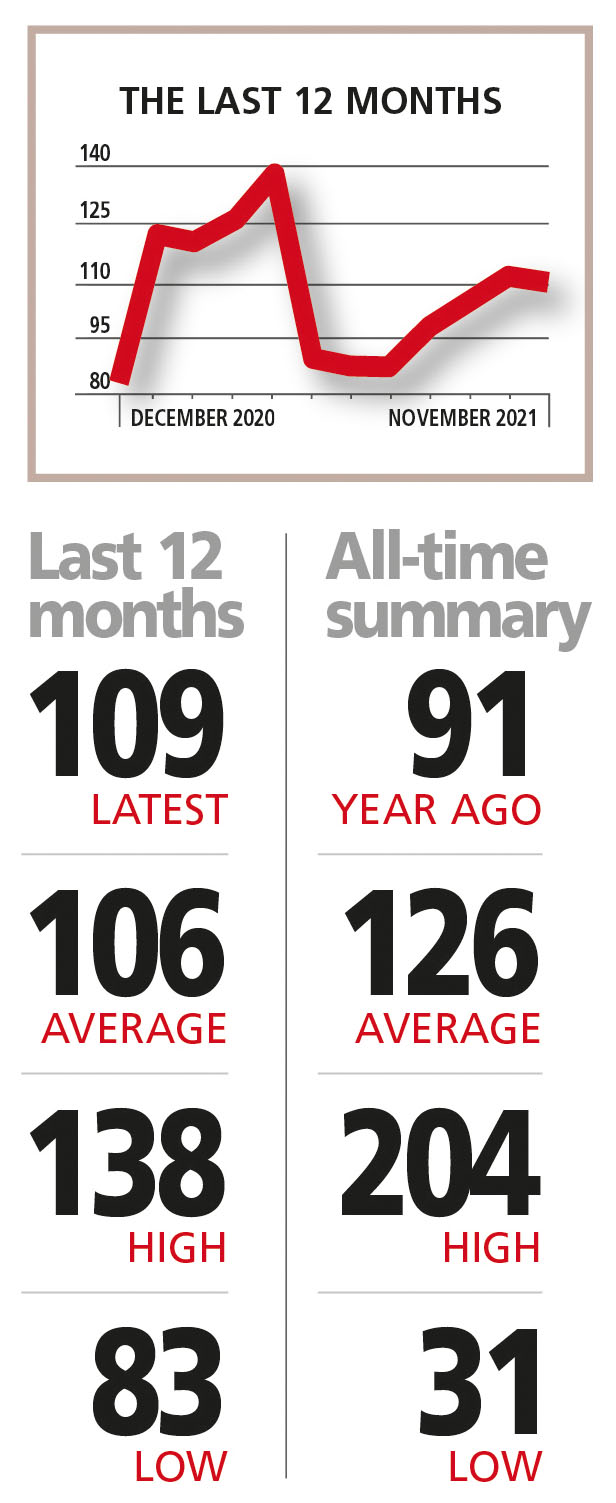

THE INDEX The BCI registered a slight fall of two basis points to 109 in November, following three consecutive months of increases.

However, this marks an improvement compared to where the index stood a year ago (91) and places it three points above the 12 month average.

NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya offers insights into the latest survey’s results: “The COVID-19 situation has abated, and the country has finally opened up with provincial travel restrictions lifted and schools also opening. But the havoc caused by the virus is being felt acutely in every segment of society.”

SENSITIVITIES Commenting on the future of the BCI, Miyanadeniya says: “The road to recovery looks steep with much sacrifice and effort needed, from businesses and the people. With the budget proposals not offering any concessions for either segment, it is likely that both the BCI and CCI (Consumer Confidence Index) will either stay the same or decline once more.”

PROJECTIONS In the November edition of LMD, we said that the business community’s perception of Budget 2022 would be crucial to the trajectory of the index along with the lockdown restrictions being eased.

Amid concerns being raised about the government’s approach to meeting Budget 2022’s revenue targets as the country continues to tackle economic uncertainties on multiple fronts, as well as fears about another wave of the pandemic, it seems unlikely that business confidence will see a drastic improvement – not unless these challenges are addressed.

What’s more, the budget proposals are likely to dampen confidence in the near term at least, given the reactions of chambers of commerce and businesspeople in general.