BUSINESS SENTIMENT

EMERGING SIGNS OF A REVIVAL

Biz confidence picks up with corporates planning to get back to doing business

Hot on the heels of a scathing review of the country’s monetary policy by President Gotabaya Rajapaksa on 16 June, in response to the COVID-19 crisis, the Central Bank of Sri Lanka announced a further reduction of the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks (LCBs).

This lowering of the SRR by 200 basis points (that’s a total of 300 basis points so far this year) to two percent is expected to inject Rs. 115 billion of additional liquidity to the domestic money market, “enabling the financial system to expedite credit flows to the economy while reducing the cost of funds of LCBs,” according to a statement issued by the Central Bank later that night.

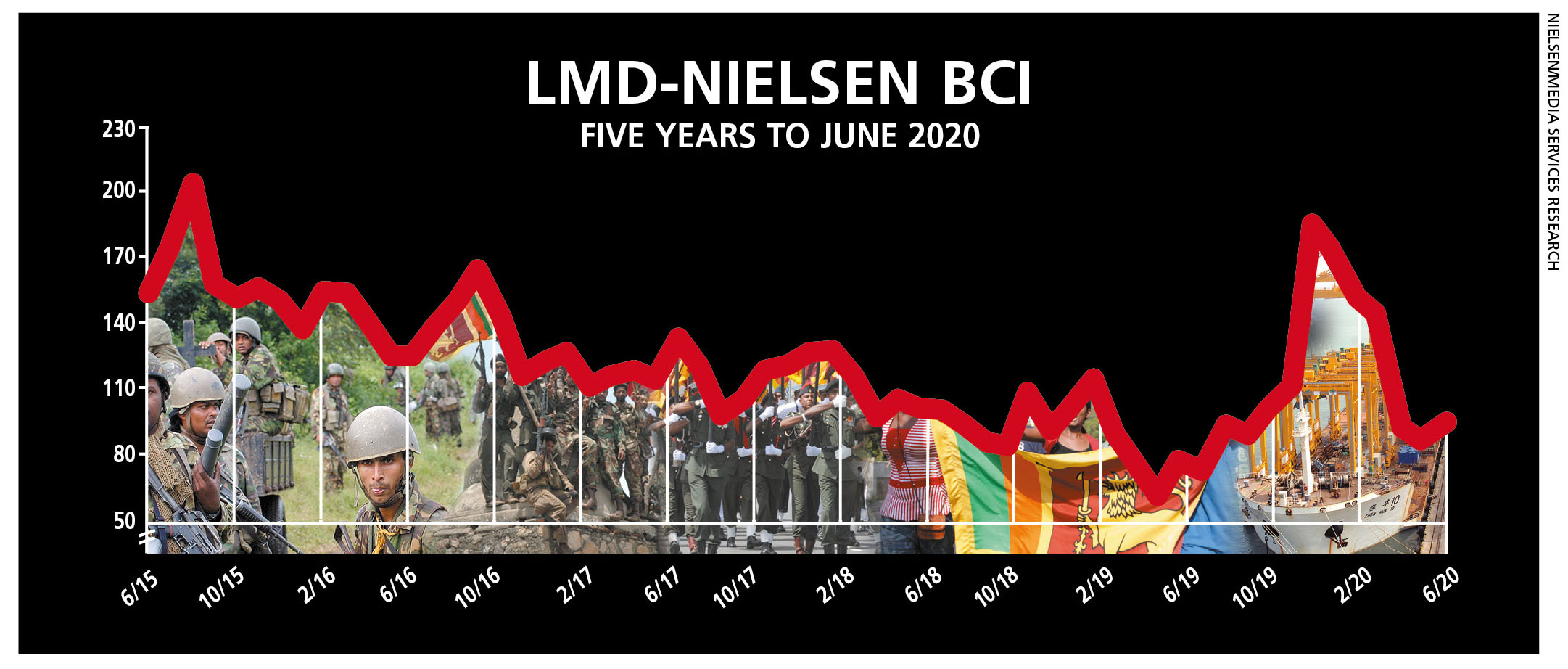

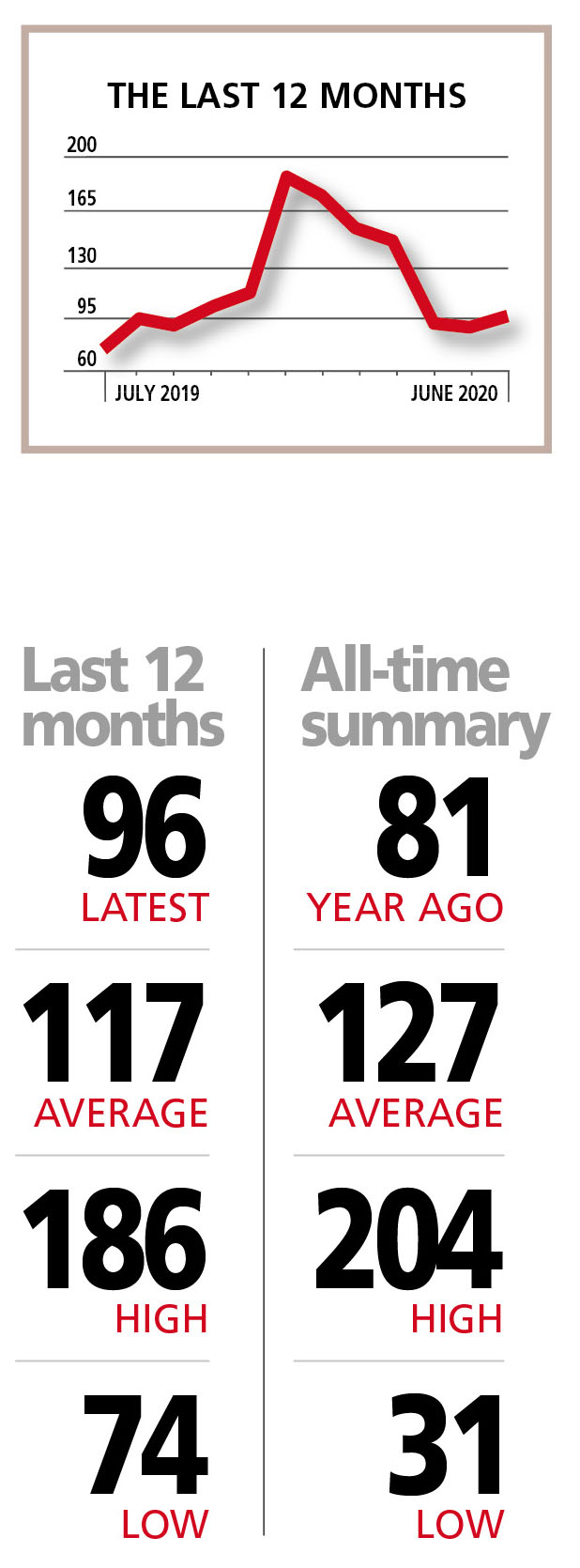

Meanwhile, the latest LMD-Nielsen Business Confidence Index (BCI) paints a more optimistic picture than witnessed previously this year.

THE INDEX The BCI has begun to pick up for the first time in 2020, rising by seven basis points from the previous month to 96 in June. This also marks an improvement compared to where it stood a year ago (81) when the nation was reeling from the 4/21 attacks although the index is still 21 points shy of its average for the last 12 months.

According to Nielsen’s Director – Consumer Insights Therica Miyanadeniya, “optimism is on the rise once again and sentiment is positive as the country has opened up ahead of others in the region. The civilian population, businesses, and private and public enterprises are adjusting to a post-COVID life with many stringent measures put in place to curb a second wave of the pandemic.”

She adds: “Following more than three gruelling months of lockdown, life is gradually adjusting to a ‘new normal’; and companies, businesses and enterprises are picking up from where they left off to salvage what they can over the next half of the year.”

Moreover, she notes that “the resilience of the Sri Lankan people and businesses – who have weathered far more in the past amid a near 30 year civil war and more recently, the Easter Sunday bombings – is evident as they start to rise up like a phoenix from the ashes.”

SENSITIVITIES The impact of the coronavirus continues to feature prominently among the most pressing issues for business today with the value of the rupee and inflation also warranting mentions by survey respondents – but to a far lesser extent than COVID-19. Financial instability is another emerging issue that’s highlighted.

According to those consulted by the pollsters, COVID-19 is also the most pressing national issue at this time.

PROJECTIONS As life appears to be gradually gaining a semblance of normalcy, and businesses begin to adjust to regaining fully operational status, we’re inclined to believe that the BCI may continue on an upward trajectory.

Furthermore, with the general election scheduled for 5 August and the prospect of an end to the political stalemate of recent months, we may continue to witness an uptrend in business confidence.

The other side of the coin is whether or not the anticipated business turnaround will eventuate – and crucially, how soon. That’s anyone’s guess.