BUSINESS SENTIMENT

CONFIDENCE SLUMPS TO A 44-MONTH LOW

Businesspeople rail against the prevailing economic and investment environment

Earlier this year, a team from the International Monetary Fund (IMF) visited Sri Lanka to review progress on the government’s ongoing economic agenda, which has been propped up by the international lender’s Extended Fund Facility (EFF).

In its assessment, the IMF mission noted that “overall, macroeconomic performance in the second half of 2016 was mixed with gradually recovering growth, and an uptick in inflation due to the impact of drought and the VAT increase. The current account remained stable but the financial account weakened with the resumption of capital outflows. A more prolonged drought could raise food and oil imports with an adverse impact on growth, inflation and the balance of payments.”

Some of the aforementioned concerns are also reflected in the verdict delivered by corporates via the latest LMD-Nielsen Business Confidence Index (BCI), which paints a less-than-inspiring picture of the state of business in the island.

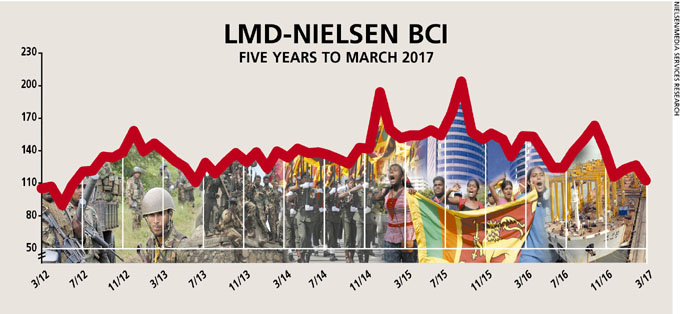

THE INDEX The upward momentum in the BCI in the first two months of 2017 has evidently come to a grinding halt as the index drops by 15 basis points to 112 in March. This score is even lower than in December 2016 (117) in the aftermath of Budget 2017 with the index perched at its lowest point in as many as 44 months. It is also 23 basis points shy of the average (135) in the last 12 months.

As Nielsen’s Managing Director Sharang Pant points out, “negative sentiments have crept back in,” which is brought into focus by the share of respondents who believe that the economy will be worse off in 2017.

Pant refers to “the upward movement of interest rates affecting the cost of doing business” and “drought-driven inflation impacting consumer demand” being viewed as deterrents to corporate growth.”

He elaborates: “The World Bank and IMF have commended efforts on fiscal consolidation, Fitch has revised its ratings for Sri Lanka from ‘negative’ to ‘stable,’ and special infrastructure companies are being established to oversee existing and new projects.”

“Yet, the private sector claims that the country’s investment climate remains unattractive and is looking for policy consistency. Pressure on the balance of payments, a rising oil bill amidst the drought, issues with loan repayments and fears of currency depreciation are causing more anxiety,” he concludes.

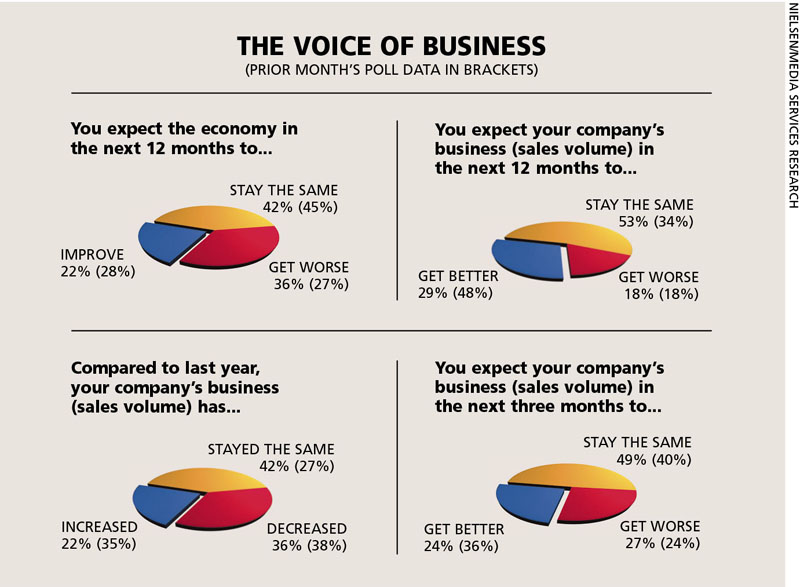

THE ECONOMY More than a third (36%) of respondents believe that the economy will be worse off in 2017 – this number stood at only 27 percent in February.

In the words of one businessperson, “the government needs to take responsibility for the state that our economy is in at present… I do not see how this situation will improve in the future unless there are drastic changes politically as well as to the economy.”

BIZ PROSPECTS Meanwhile, more than half the survey sample feel that business performance will remain the same in the coming 12 months.

The short-term outlook too appears bleak with only 24 percent predicting a strong quarter going forward. This number has fallen steadily in recent months.

However, a corporate executive consulted by the pollsters asserts that “with several infrastructure projects coming up that would help promote tourism, I think our business activities will grow further in the future.”

INVESTMENT The investment climate is turning decidedly overcast with a meagre 10 percent of business leaders expecting a brighter outlook. Moreover, almost half the sample population feel that this is not a good time to invest.

“How can we say that the investment climate in the country is good when our economy seems to be constantly fluctuating? Investors aren’t willing to invest in the economy because there is a lot of uncertainty,” a member of the biz community declares.

Nevertheless, another corporate executive states that “with several large-scale infrastructure projects coming up, there seems to be some progress. This is a good sign, the businessperson avers, as it will induce more investors both local and foreign to take an interest in our economy.”

WORKFORCE A majority (82% – versus 76% in February) of businesspeople spoken to by the pollsters point to simply maintaining their organisation’s workforce in the six months ahead.

And only 12 percent expect their organisations to increase staff numbers while a further six percent say their companies are likely to witness a decline in the employee count.

PROJECTIONS Any hope of a mild recovery in sentiment being in the works – as we alluded to in last month’s edition of the BCI – has been shattered by the latest survey outcome.

With the ‘political culture’ being termed the most pressing national issue facing Sri Lanka today and ‘political interference’ taking third place among key concerns for business, the writing is seemingly on the wall for any prospect of meaningful change.

We did state last month that a mild upturn would depend on there being “a cap on the extent of political interference in business, which some may say is wishful thinking!” Well the nation’s corporates have spoken and they affirm that any redress from the status quo is indeed wishful thinking!

So we head into a traditionally ‘festive’ period with a sense of scepticism over where the unique index will meander in the coming months. In this scenario, where the BCI will turn next month is anyone’s guess.

– LMD