MONEY TALK

Compiled by Yamini Sequeira

EYEING AN ECONOMIC REVIVAL

Dimantha Seneviratne posits that banks must remain robust in the long term

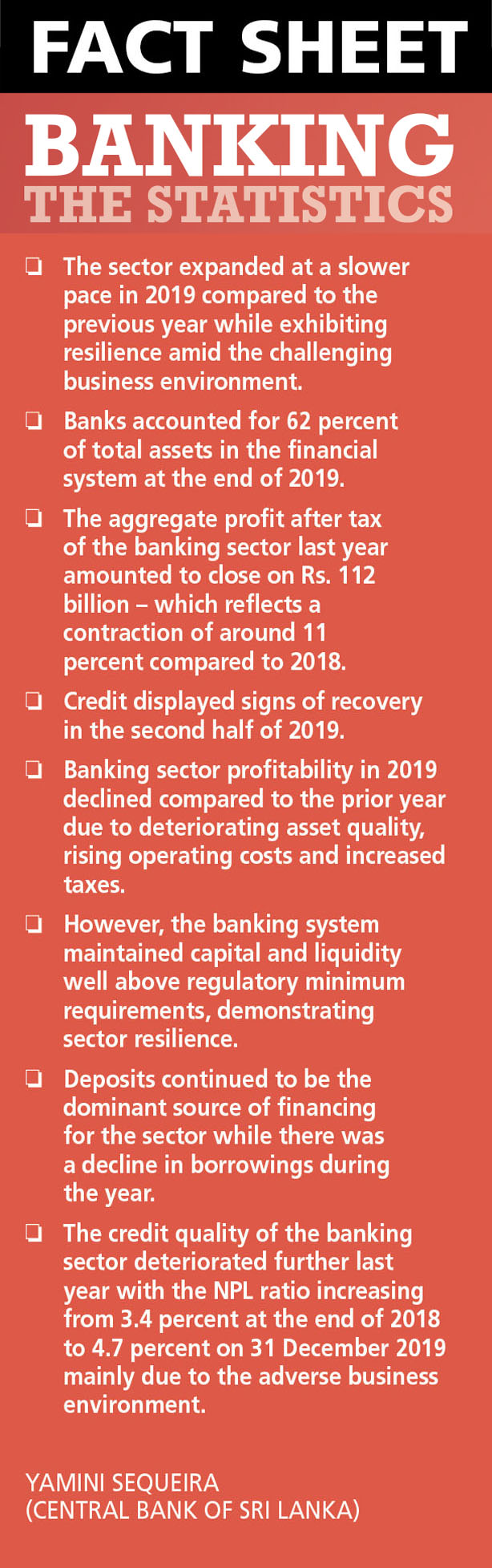

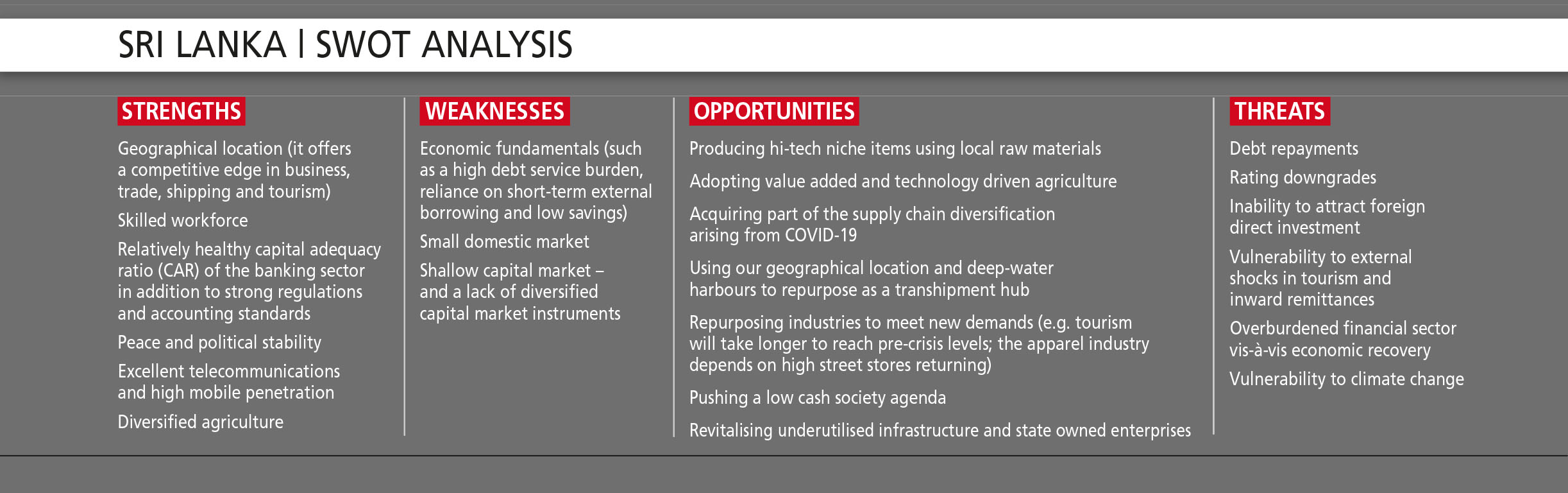

The banking sector was poised for an economic revival in 2020, coming out of two years of subdued economic growth coupled with the after-effects of the April 2019 Easter Sunday attacks. There was optimism riding on the back of political stability, improved business sentiment, revised tax policies and SME focussed support schemes geared to jumpstart the economy.

Alas, all that changed in the first quarter of the present calendar year when COVID-19 surfaced as the ‘new normal.’

Dimantha Seneviratne offers his perspective: “The banking sector’s immediate response to the COVID-19 pandemic was to ensure uninterrupted day-to-day transactions, availability of cash and functional payment systems. Indeed, the sector faced the task of sustaining the economy for which banks are well equipped.”

“The most apparent impact so far has been the loss of business volumes and potential balance sheet growth opportunities. On the income side, fee income will reduce sharply in line with lower transaction volumes. But there will be some savings on the cost side due to lower levels of operation,” he adds.

CREDIT RISK The extent to which this will affect the profitability of banks would only be known in the long run but lower business volumes will be reflected in their profit and loss statements.

“Bank infrastructure is geared to handle a certain volume of transactions. If these volumes don’t materialise, banks have to carry the excess capacity at a cost. However, balance sheet earning inertia, which is expected to sustain banks, will be impacted by the cost of moratoriums coupled with low interest rates and lower fee income taking a toll on profits,” Seneviratne points out.

With reference to extending moratoriums to SMEs as directed by the government and how this will affect the banking sector, he states: “SMEs are the backbone of the economy; it is in the interests of the banking sector and country as a whole to help keep them afloat. Of course, this will come at a cost because it puts extreme pressure on market liquidity and bank profitability.”

Seneviratne maintains that “credit risk continues to be borne by banks. Some industries may not recover within the relief period so support will be required over a longer time frame. Accordingly, the cost of this crisis may be drawn out longer than anticipated. But on the positive side, we expect other segments to grow in the vacuum left by affected industries.”

ECONOMIC FALLOUT In his opinion, the impact on capital requirements will depend on how well the economic fallout is managed.

“During the moratorium period, some growth capital will be blocked in non-earning assets, which will impact the return on capital. Given that this is a global phenomenon, some key industries such as tourism may take longer to recover than the breathing space currently provided by moratoriums,” Seneviratne cautions.

He is of the view that “it is essential that possible non-performing loans (NPLs) are actively managed during this period and beyond to avoid systemic NPL issues, which might in turn take a toll on banks’ profitability and capital reserves.”

Meanwhile, the Central Bank of Sri Lanka (CBSL) unveiled a Rs. 50 billion refinancing scheme – Saubagya – aimed at supporting the working capital requirements of SMEs and corporates.

Seneviratne adds: “Based on the requests received to date, this sum might not be adequate. CBSL has taken further steps to increase liquidity in the market – to help banks manage the liquidity requirements more effectively.”

CREDIT GUARANTEE Speaking on behalf of the sector, Seneviratne emphasises that “it’s in the interest of the country to ensure that the banking sector remains robust in the long term. In the recent past, banks have acted as a tax aggregator for the government when they were taxed at approximately 59 percent. Currently, this rate is down to around 43 percent.”

He continues: “However, the regulator can help ease the burden of moratoriums by supporting a request by the Sri Lankan Bankers’ Association for a tax concession on accrued interest during the moratorium period. If the regulator can offer a credit guarantee scheme especially covering SME lending along with an enhanced longer term refinancing scheme, this will help banks assist customers with tailored solutions.”

SUPPORT SCHEMES Contemplating the impact, he notes that “in the short term, the focus of banks would be to roll out support schemes to customers and help them navigate these challenging conditions. During this time, banks will witness reduced profitability to some extent. But in the medium term, they have to adjust to a new normal.”

According to Seneviratne, “the more prudent banks would have already embarked on this journey. We’ll witness new and efficient business models, backed by technology and tapping into the internal synergies of organisations. Banks will shift to an advisory and solution driven approach from the present transaction focus.”

In the past few years, the banking sector has witnessed a continuous increase in non-performing assets (NPAs) and COVID-19 isn’t expected to change this trend. Medium-term government policies will determine the real impact of NPAs and while moratoriums offer breathing space for industries, a longer handholding period would be required to ensure a complete recovery.

THE NEW NORMAL Speaking candidly, Seneviratne says that “compared to the region, Sri Lanka was behind in terms of adopting coherent online and digital solutions. Both banks and the public were lax in adopting them.”

“The crisis provided the impetus and urgency to complete these projects; and more importantly, the public was forced to adopt mobile and online banking,” he adds.

Seneviratne continues: “While there was an increase in the adoption of mobile banking apps and online transactions, we must also understand that lower economic activity nationally would mean there would have been less necessity to transact. Banks that made these investments were able to provide innovative solutions faster – such as ‘banking on wheels’ and mobile ATMs. This not only helped retail customers but also assisted corporates with their collections.”

Looking ahead, Seneviratne’s wish list includes a more liberal monetary policy to take the economy out of the prospect of a recession.

“Increasing liquidity through lower reserve ratios and interest rates to encourage credit growth will support the economy, as will enhancing refinance schemes to enable banks to extend credit to deserving sectors. There has to be healthy coordination between monetary and fiscal policies to boost the economy,” he muses.