BANKING SECTOR

Compiled by Yamini Sequeira

BEYOND THE COMFORT ZONE

Sujeewa Rajapakse notes how COVID-19 has forced banks to think outside the box

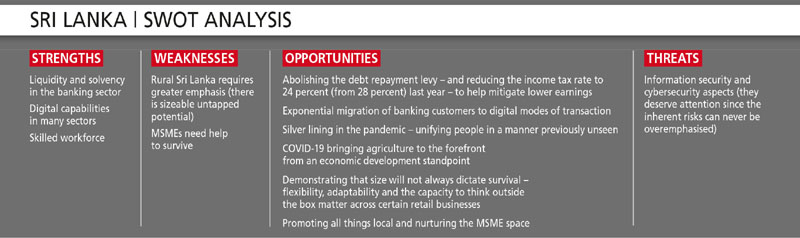

The banking sector was in distress even prior to the COVID-19 outbreak primarily due to macro level stresses that included the inevitable consequences stemming from a slowdown in economic growth to 3.3 percent and 2.3 percent in 2018 and 2019 respectively compared to a 10 year historical average of over five percent, and an operating environment characterised by inflationary pressure and interest rate volatility.

In addition, sector earnings were under pressure due to the imposition of additional taxes and levies. These consequences were exacerbated by the Easter Sunday attacks of April 2019.

Assessing the state of the banking sector, Sujeewa Rajapakse explains that “the implications of these stresses were primarily on three fronts. Industry gross nonperforming loans (NPLs) and advances to total gross loans rose to 4.7 percent at end 2019 from 3.4 percent at end 2018 and 2.6 percent at end 2017.”

“This slowed credit growth as the sector was extremely cautious in maintaining the quality of its loan book without further deterioration. Credit growth is fuel for economic activity,” he adds.

Rajapakse continues: “From a borrower’s perspective, the cost of funding wasn’t cheap. To put this into context, the sector’s net loans expanded by five percent in 2019 compared to an average 17.7 percent growth year on year over the preceding three year period. The end result was that the sector return on assets consistently slipped to 1.4 percent in 2019 from 1.8 percent in 2018 and two percent in 2017.”

“COVID-19 has elevated the levels of risk in a manner previously unseen,” he acknowledges.

Rajapakse states that at 30 June last year, while the sector’s gross NPLs increased to 5.4 percent of total loans, this is likely to rise further before it begins to improve. Numerous government initiatives taken and underway to bolster economic activity particularly at the grassroots level, supported by global developments on the COVID-19 vaccine front, are all positive towards making 2021 a year of rebound.

The sector is equipped to support such growth aspirations, benefitting from encouraging levels of liquidity and solvency, he notes.

PANDEMIC IMPACT The impact of the COVID-19 crisis is unprecedented and this is best described by the Central Bank of Sri Lanka’s (CBSL) projection that the economy will contract by 1.7 percent in 2020 – a first for the country since 2001 and only the third such instance over the last 60 years.

COVID-19 has left no country less susceptible and no sector immune, having hampered the day-to-day lives and livelihoods of millions of people. Segments such as tourism, apparel and textiles, tea and other export businesses, construction and transport, which are among the hardest hit – coupled with daily wage earners and those engaged in the micro, small and medium enterprise (MSME) space – are the most vulnerable.

“From a banking sector standpoint, the financial consequences have primarily been twofold – viz. in the form of the cost of interest concessions extended during the relief period and a rise in credit losses. With at least a third of sector borrowers being beneficiaries of some form of relief, the full extent of such implications is only likely to be known following the conclusion of all relief measures,” Rajapakse notes.

He adds: “Digital will be at the heart of every strategic initiative and decision-making process. The regulator’s push to being more cashless through the use of a QR code amongst others will be a hot press item in the year ahead.”

“There will be technology centred heightened collaboration between institutions and operating virtually, and the increased adoption of cloud-based solutions will be strongly pursued across all regulatory permitted aspects of business operations,” he adds.

ECONOMIC REVIVAL From a credit angle, banks are likely to increase their allocations to the MSME space in recognition of the fact that the segment is key to a speedy economic revival. While customers’ credit quality will continue to come under pressure, the level of deterioration is likely to taper off as some of the government’s economic revival initiatives come to fruition, Rajapakse believes.

ECONOMIC REVIVAL From a credit angle, banks are likely to increase their allocations to the MSME space in recognition of the fact that the segment is key to a speedy economic revival. While customers’ credit quality will continue to come under pressure, the level of deterioration is likely to taper off as some of the government’s economic revival initiatives come to fruition, Rajapakse believes.

He elaborates: “Whilst there were several efforts to reduce interest rates in 2018/19, due to multiple factors these did not achieve the desired outcome. As for 2020, the monetary policy measures have laid the groundwork necessary for an economic rejuvenation.”

“To date, the Monetary Board has initiated five policy rates cuts, which has set the tone for a low interest rate environment, supplemented by a statutory reserve ratio (SRR) reduction to two percent from five percent at end 2019. This alone has infused over Rs. 170 billion in liquidity into the financial system,” Rajapakse notes.

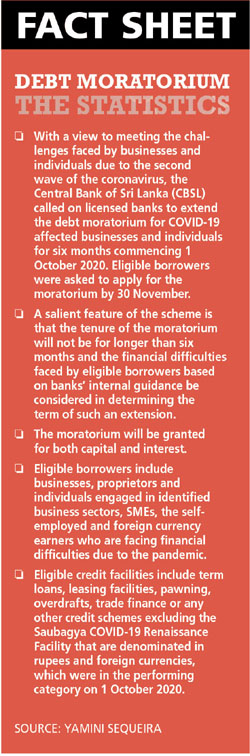

In this context, it is also worth recognising certain initiatives undertaken by CBSL from the perspective of facilitating COVID-19 relief for the benefit of impacted customers, the introduction of the Saubagya loan scheme for the benefit of SMEs, and efforts to preserve and protect the rupee from substantial depreciation by way of controlling nonessential imports among others.

“From a banking and financial institution point of view, aiding not only their survival but also revival is vital to long-term economic prosperity. Creating know-how and financial discipline over a period of time is key to long-term sustainability. There is also a growing trend where those who have lost their jobs have ventured into the MSME space, which makes supporting the sector even more important,” Rajapakse cautions.

POSITIVE DEVELOPMENTS COVID-19 has forced everyone to think outside the box as best demonstrated in the banking sector’s unrelenting efforts to meet the financial needs of customers in the wake of such crises, and at a time when there was no visibility and yet notable risks.

In fact, several other developments are taking place in the digital space, which are promising in terms of enhancing operational efficiency and customer satisfaction, and reducing costs. It is Rajapakse’s firm belief therefore, that even when the pandemic is brought under control, the positive developments that have emerged should be continued.

In summing up, he states: “In terms of the outlook for 2021, it is reasonably expected to be a year of rebound not only locally but globally too. With notable progress already taking place in the COVID-19 vaccine development arena, I look forward to the future with a high degree of optimism.”

The interviewee is the Managing Partner of BDO Partners and Chairman of People’s Bank