BANK OF CEYLON

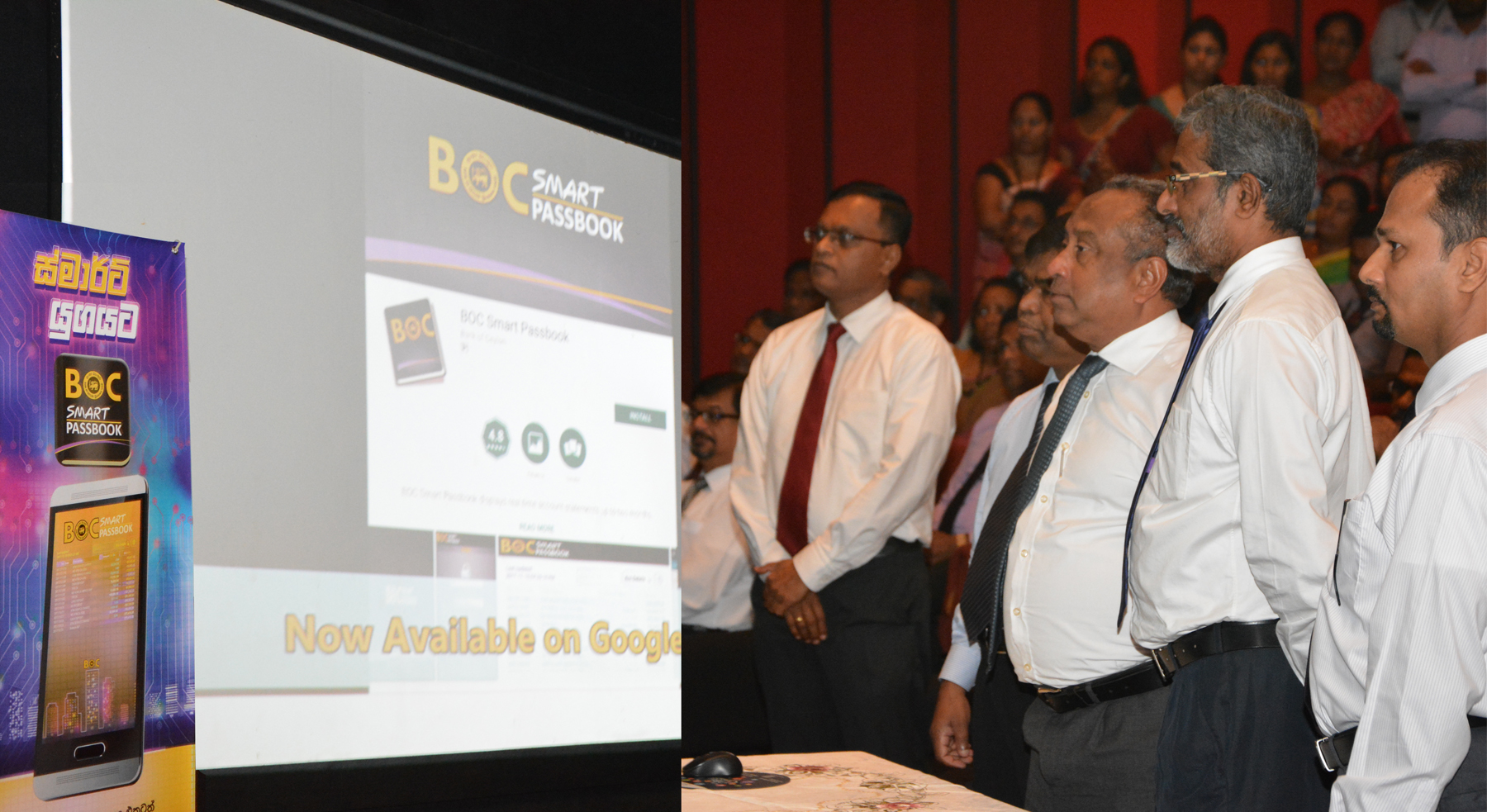

Bank of Ceylon moving towards futuristic e-banking, launched ‘SMART PASSBOOK’ honoured by the presence of Chairman, Mr. Ronald C Perera, President’s Counsel, General Manager Mr. D M Gunasekera along with the Corporate and Executive Management at Bank of Ceylon Head Office. BOC ‘Smart Passbook’ a digitalized enabled value addition provides access to transactions and balance history on real time through smart mobile devices.

Smart Passbook a freely downloaded app on Google Play Store, is an electronic version of traditional passbook / Current Account Statement. Currently available on smart mobile devices running on Android Operating System, the Bank expects to enable this service on Apple devices in the near future.

Special features on app include self registration, optional log-in PIN, FAQ service and availability of registration upto three mobile devices. Accountholders are able to view on app account balance and transactions of Savings / Current including foreign currency accounts. Possibility of real time on-line view of recent transactions, current month statement and last month statement. Last viewed transactions are displayed on offline mode too.

Bank of Ceylon on digitalization journey has so far introduced Smart Zones [self-service banking area], Cash Deposit Machines, Self-Service Kiosks, automated account opening, on-line loan services via website, Smart FDs, Mobile Branches and e-statements. The Bank anticipate launching a mobile banking app and new internet banking site by end December.